LONDON (CelebrityAccess) — Hipgnosis Songs Fund, the troubled music intellectual property investment company announced that it has accepted a bid from Concord to acquire the company for $1.4 billion.

The valuation from Concord, approximately $.93 a share, is a premium of more than $32 percent over Hipgnosis’s closing price on Wednesday. Financing for the deal will come in part from Hipgnosis’ long-term financing partner, Apollo Global Management, the company said.

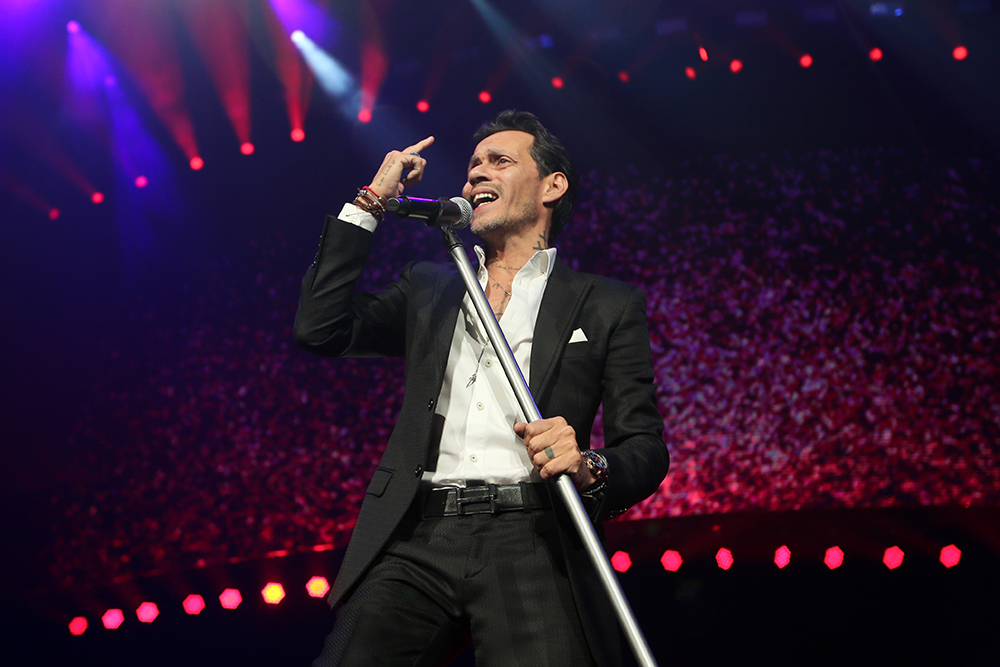

Founded in 2018 by Merck Mercuriadis and Nile Rodgers, Hipgnosis helped to kick off the modern era of big ticket music rights acquisitions by investors and the company snapped up high-profile catalogs from artists such as Red Hot Chili Peppers, Beyoncé, Shakira, Neil Young and Blondie.

However, the company has been hindered by shareholder discontent over its relationship with its investment advisor, Hipgnosis Song Management, and reporting issues on the value of the company’s portfolio of music rights.

Under the terms of the deal, Hipgnosis Songs Fund will terminate its investment advisory agreement with Hipgnosis Song Management, according to a news release.

“The Board is pleased to announce and unanimously recommend this US$1.4 billion Offer for Hipgnosis from Concord. The acquisition represents an attractive opportunity for our shareholders to immediately realize their holding at a premium, mitigating the risks we see ahead to achieve a material improvement in the share price. At the same time, the Board is confident that Concord, one of the world’s leading independent music companies, is the right owner to take on the Hipgnosis catalogue and manage it in the interests of composers and performers,” said Robert Naylor, Chairman of Hipgnosis.

“We would now encourage Hipgnosis Song Management, the Company’s Investment Adviser, and Blackstone, which is HSM’s majority owner, through funds they manage and/or advise, to agree an orderly termination of the Investment Advisory Agreement. This would enable the payment of a larger consideration under the agreed transaction with Concord and bring to an end a period of uncertainty for all Hipgnosis stakeholders,” Naylor added.

“We are pleased to be announcing this Offer for Hipgnosis, which has been unanimously recommended by its Board and has the support of 29.38 percent. of their shareholders. We believe we are offering a fair price for Hipgnosis’ catalogues and music assets, giving its shareholders the opportunity to realize their investment at a significant premium to the prevailing share price in cash,” said Concord CEO Robert Valentine stated.

“Concord is the world’s leading independent music company, with extensive experience in developing, producing, and marketing recordings and songs around the world in order to maximize their value. We believe we can integrate Hipgnosis’ catalogues into our wider portfolio of 1.2 million songs in a way that will deliver benefits for composers, performers and all our stakeholders,” Valentine added.