NEW YORK (CelebrityAccess MediaWire) — CKX, Inc. has declared and transferred into trust for its stockholders a dividend consisting of 25 percent of the common equity interests, on a fully diluted basis, in the business of FX Luxury Realty LLC. The plan to distribute these interests to CKX stockholders was previously disclosed at the time the company acquired its 50 percent ownership interest in FX Luxury and announced a buyout offer for the company of $13.75 per share in cash.

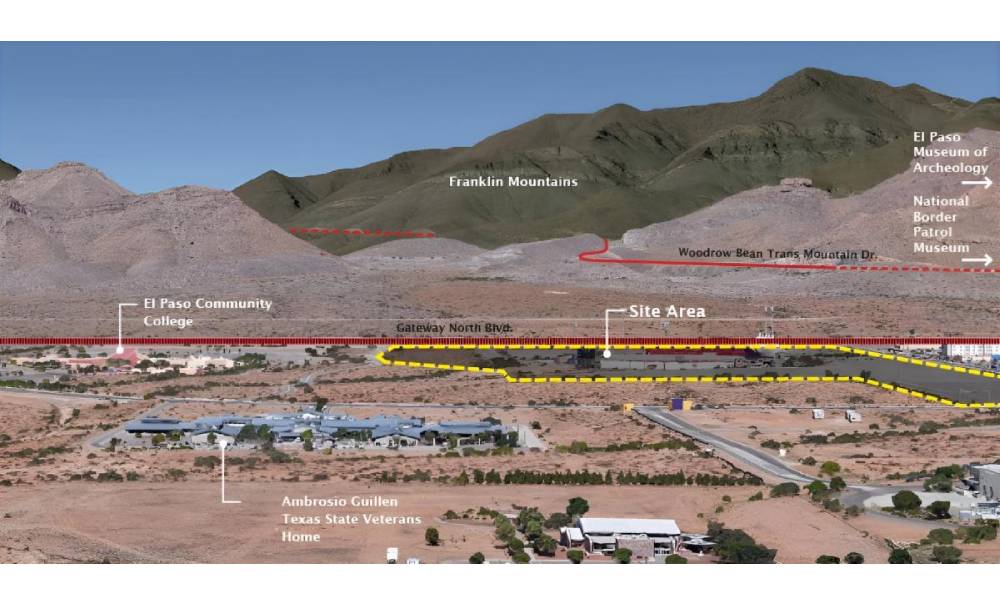

The distribution of shares in FX Luxury is intended to give CKX stockholders a continuing interest in the exploitation of CKX's Elvis Presley and Muhammad Ali assets, notwithstanding the proposed sale of the company, through FX Luxury's Elvis Presley- and Muhammad Ali-themed real estate projects and transactions.

The shares will be distributed to shareholders of record on the record date, which will be 10 days following the date on which a registration statement with respect to the shares is declared effective by the Securities and Exchange Commission. Stockholders will receive the FX Luxury shares approximately 10 days following the record date. Between now and the distribution date of the shares to CKX stockholders, the shares will be held in two trusts formed for the purpose of holding the shares for the benefit of CKX stockholders. The transfer of the shares to the trusts is irrevocable and neither CKX nor its creditors have any control over or continuing interest in the shares.

Shortly following payment of the dividend to the CKX stockholders, FX Luxury intends to commence a rights offering that will give each CKX stockholder the exclusive right to purchase an additional share of FX Luxury stock for each share of stock received in the CKX dividend, providing CKX stockholders an opportunity to double their interests in FX Luxury.

–Bob Grossweiner and Jane Cohen