WASHINGTON, DC – The live music industry halted as the COVID-19 pandemic raged on. As millions fell ill across the country and the fights began over being vaccinated vs. unvaccinated, the thought of being inside of a music venue with 1000 other sweaty fans was as encouraged as a nail in the eye.

Independent venues across the country struggled; more than a few shuttered their doors, and they reached out for help. So, as Congress sat down and discussed an aid package for indie live music venues and other performance venues, Live Nation (LN) lobbied Congress to be included in the relief package. According to five sources who reported to The Washington Post – Live Nation, the corporate parent company of Ticketmaster, asked Democrats and Republicans to allow it to be eligible for the $15 billion emergency aid program. Those sources only spoke under the condition of anonymity.

Congress was leaning towards not allowing any grants for publicly traded companies such as Live Nation, fearing the money would go to bail out stock market investors. Lawmakers wrote the aid package to exclude large companies, such as Live Nation, and firms they own or control.

Congress and the Small Business Administration (SBA) (which disbursed the funds) set the parameters for the aid package but allowed several companies in which LV has significant investments to receive grant money. According to a Washington Post review of numerous sources*, $19 million went to firms listed as subsidiaries on LN’s 2022 securities filings or in which LV has a substantial stake. The grants appear not to have violated the law or any rules set by the SBA. The study shows how an industry giant with stakes in hundreds of smaller businesses could reap benefits that lawmakers didn’t want without breaking a single rule, showing it’s essential to implement the laws and just as crucial is how those laws are written.

“When we wrote this, we specifically didn’t want these publicly traded companies – Live Nation foremost among them – to get their hands on this money. I did not want Live Nation getting a nickel.” – Rep. Peter Welch, D-VT., (Co-sponsor of the relief legislation)

LN did not directly receive any money from the program, but the government relief to its subsidiaries still protected its investments and improved its long-term outlook. One of the companies that received funds from the SBA borrowed money from LN in the first months after COVID arrived, showing how LN kept them alive. In another case, one of LN’s subsidiaries that received grant money didn’t need to tap into an already established and available LN credit line, showing how the government grant protected the parent company from financing the subsidiary venue’s survival if just for a little while.

According to SBA data, the companies listed as LN subsidiaries in the February SEC filings and received relief funds are:

Frank Productions Concerts, LLC ($10m)

Gellman Mgmt., LLC ($407,000)

Delmar Hall, LLC ($1.75m)

The Pageant, LLC ($6.7m)

Frank, Gellman, and Delmar are included on a list of hundreds of subsidiaries filed as part of LN’s annual report for 2021. The Pageant, LLC and Delmar Hall, LLC, is 50% owned by LN, per Patrick Hagin, the managing partner for both businesses. He then said that Delmar was mistakenly listed as an LN subsidiary.

LN says they do not have majority ownership or a controlling stake in any company that received aid funds. “Therefore, we don’t have the ability to tell these partners that they can’t get access to these funds, especially considering the SBA reviewed and approved their applications before any funds were given out,” the company’s statement said. “These entities control their own day-to-day operations, and the folks running these small businesses used every resource legally available to them to support their employees through this crisis, which was not only their right but also an entirely understandable and human thing to do.”

The Shuttered Venue Operators Grants (SVOG) were approved and passed by Congress in late 2020 and offered relief of up to $10 million to venues, museums, producers, and talent managers. The money was approved at a time when the live music industry was shut down due to COVID restrictions. As the pandemic waged on, Congress ended up with relief money totaling more than $16 billion. The “Save Our Stages” plan was born – and The National Independent Venue Association (NIVA), created as a response to the pandemic, was a driving force behind the grant program.

Congress approved the aid measures, but public companies or venues or firms “majority-owned or controlled” by such companies were excluded from any grant monies. While Congress wrote the program’s rules, the exact requirements and disbursement of the funds were handed to the SBA, and that’s where it gets murky.

The SBA defined “control” as “both the strategic policy setting exercised by boards of directors or similar organizational governance bodies and the day-to-day management and administration of business operations as overseen by principals,” according to an agency document on the program. In other words, a firm could be the largest single shareholder of a subsidiary but not technically “control” it.

The SEC’s definition of “subsidiary” is “an affiliate controlled by such person directly, or indirectly through one or more intermediaries.”

That is how Frank Productions, a concert venue promoter received $10 million from the SBA grant program, the maximum allowed. Frank Productions and Frank Productions Concerts are listed as LN subsidiaries in the SEC filings. Joel Plant, Chief Executive of Frank Productions, told the Post in an email, “The day-to-day operations and management of FPC remains the responsibility of our local management team. The filing of annual reports is an administrative function that LN has taken on as part of its just venture with Frank Productions, LLC.”

In a phone interview with the Post, “We have mechanisms with Live Nation to lend us money that we did not access during covid,” Plant said. “The intent of the (SVOG) program was to keep people employed and keep businesses operating, and it did that. There was a pretty complicated and thorough set of rules and guidelines promulgated about the program. We read through them carefully, and we are eligible at the FPC level to receive the funds.”

Gellman Management also emailed The Washington Post, “None of these funds were allocated for personal gain of management nor Live Nation,” the statement said.

“We did everything by the book and followed all of the guidelines outlined by the SVOG, and it is unfair and incorrect to insinuate otherwise.”

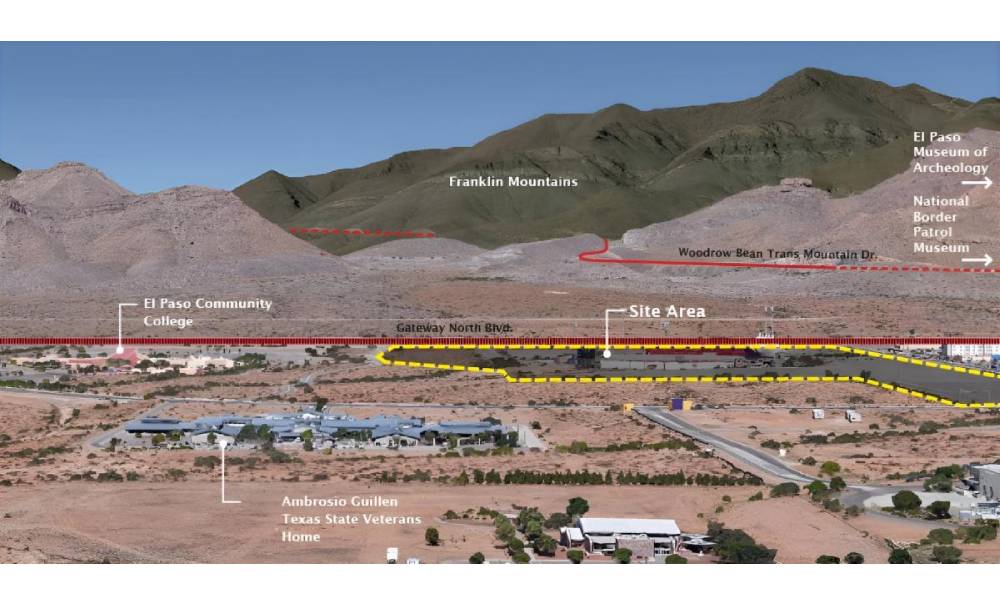

According to SBA data provided by Hagin, St. Louis venues, Delmar Hall, and The Pageant, LN holds a 50% stake and is the largest single stakeholder. Because the two venues are 50% owned by LN and not 51% owned by LN, Hagin said, the venues qualified for the grants. “We are following the rules here,” Hagin said in an interview with the Post. “We are very conscious of what the rules were.” Hagin disclosed The Pageant did receive a loan from LN to help its survival and that he and his business partner also contributed a “proportionate” amount. He declined to disclose how much.

Hagin said the SBA grants made an enormous difference for the venues, enabling them to retain the majority of their staff and keep up the rent/utilities. “It would have been really, really ugly without it,” he said.

SVOG program advocates emphasized the intense financial pressure that small businesses faced, including the risk that owners would lose their homes and life savings in trying to meet their obligations to employees and vendors.

“The thousands of independent venues that came together to form NIVA could not have survived the pandemic shutdowns had it not been for the emergency relief provided by the Save Our Stages Act,” said Rev. Moose NIVA’s executive director and co-founder. “Our members are small business people that don’t have access to Wall Street financial instruments to survive a historic crisis, not of their making.”

According to the five anonymous sources, live Nation lobbied Congress so it could qualify for the funds. The sources report LN lobbied hard, seeking to make the funds accessible for themselves and its many subsidiaries, large and small. They opposed language barring aid to publicly traded companies; a congressional aide disclosed to the Washington Post, once again on the condition of anonymity.

OpenSecrets, a nonprofit group that tracks money and its influence in the world of politics, reports LN’s lobbying funds doubled in 2020 as compared to the prior year to over $1 million and increased again in 2021.

In a statement to the Post, LN said its lobbying efforts increase was done to protect jobs. “As the largest employer in the live music industry, of course, we advocated for support to be available to all live music workers no matter where they work,” the LN statement said. “Ultimately, LN wasn’t eligible, and that’s ok; we still supported the bill for the good of the industry.”

Ultimately, LN did not directly profit from the SVOG. However, their involvement did help propel the initiative forward and drove home the need for aid within small live music communities – communities that remain crucial to the industry as a whole.

*Securities and Exchange Commission (SEC) filings, state corporate documents, SBA data, and interviews with executives at companies that received grants.