The Madison Square Garden Company confirmed that it is splitting the sports and live events component of the company away from its media business and turning them into two separate, publicly traded entities.

Following the split, the live entertainment company would include the following:

Professional sports franchises, including the New York Knicks, the New York Rangers and the New York Liberty, along with development teams: the Hartford Wolf Pack and the Westchester Knicks.

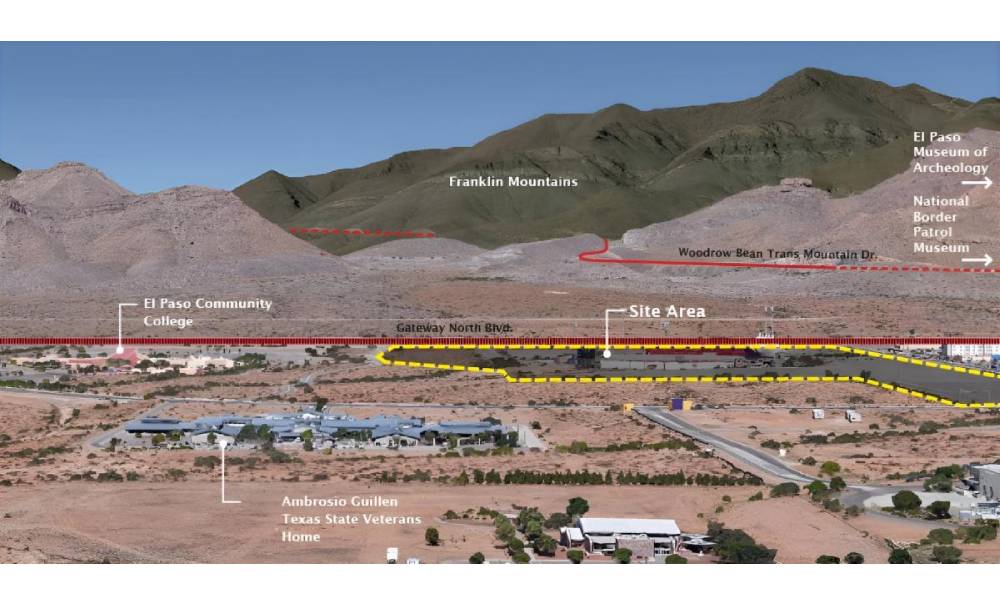

MSG's venue portfolio, including Madison Square Garden Arena, The Theater at Madison Square Garden, Radio City Music Hall, the Beacon Theater, the Forum in Inglewood, CA, The Chicago Theater, and the Wang Theater in Boston.

The company's live productions, including the Radio City Christmas Spectacular, and New York Spring Spectacular, a new large scale theatrical production that officially debuted on March 26.

MSG's venue management capabilities and booking operations, as well as its sponsorship, marketing, ticketing and promotion platforms.

MSG's interest in Fuse Media, the parent company of NUVOtv and Fuse networks

The media company will be made up of the company’s media operations, including two lucrative regional sports networks, MSG Network and MSG+. The company said it would enter into long-term media rights agreements that will allow them to continue to carry Knicks and Rangers games on their networks.

The company first revealed that it was considering breaking up last October and may pave the way for acquisition by other media companies, including Comcast.

"After review, MSG's Board of Directors believes that, while MSG has created significant shareholder value since it was established as a public company five years ago, separating MSG's live sports and entertainment businesses from its media business now would further enhance the long-term value-creation potential of both businesses. While the companies would continue to benefit from commercial arrangements between them, the separation would provide each company with increased strategic flexibility to pursue its own distinctive business plan and allow each to have a capital structure and capital return policy that is appropriate for its business. Upon completion of the spin-off, MSG shareholders would own shares in both companies and have the ability to evaluate each company's current business and future prospects in making investment decisions," the company said in a statement regarding the breakup.

The The separation remains subject to various conditions, but is expected to be completed by the end of the year. – Staff Writers