The Q2 2024 music market is at a critical turning point, revealing the growing divide of the Music Industry vs Creator Economy.

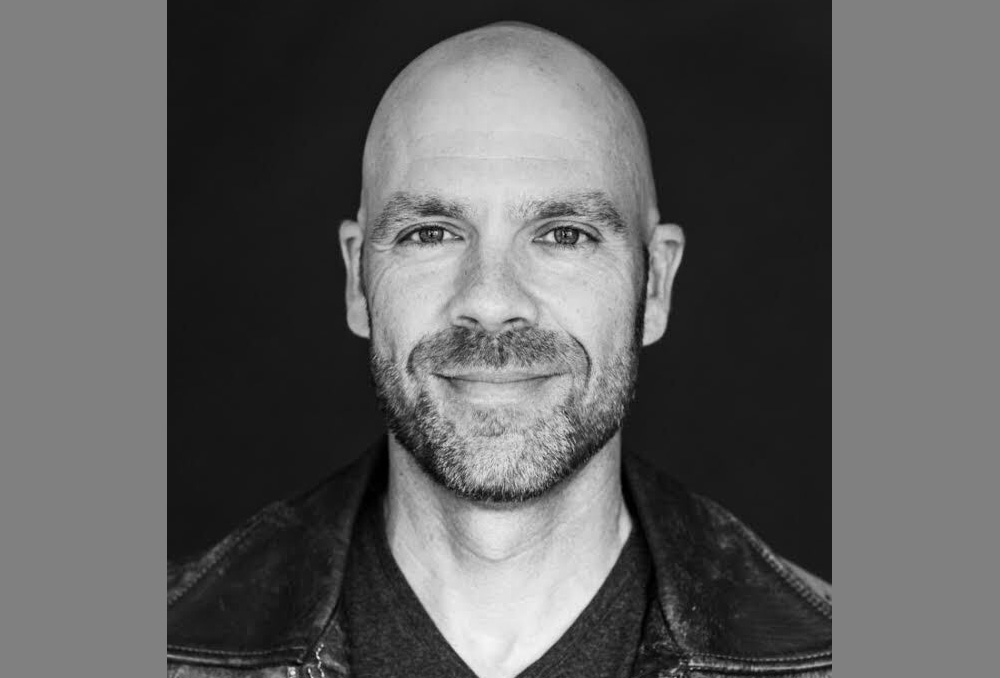

by Mark Mulligan of MIDiA Research

There are so many music industry metrics and financial results flying around these days that it can be difficult to keep up with them all. Don’t worry, we’ve got you. MIDiA has just published the first edition of a brand-new report series: quarterly music metrics. The aim of the report is to synthesize a sea of data into the insights that matter.

Here are some highlights from the first edition.

Q2 2024 faced intense music industry scrutiny, with Universal Music Group’s (UMG) streaming revenue growth lagging that of market leader DSP Spotify. A complex mix of factors contributed to this trend –– UMG pointed to sluggish performance of Amazon Music and Apple Music, though regional factors were probably the main culprit, with Spotify growing well in Global South regions where UMG is not as strong.

Earlier this week, UMG’s Sir Lucian Grainge laid out UMG’s vision for ‘streaming 2.0’ – a more segmented approach to taking the streaming market to its next phase. This included a more considered outlook of 10% annual subscriptions growth 2023 – 2028. Which is exactly what MIDiA projected in our music forecasts. It is solid and achievable growth. But one that does indeed need a fresh, more nuanced approach with the music market now bifurcating, both in business terms (DSPs vs social) and geographic terms (Global South vs Western markets).

The signs of bifurcation are already apparent with early signs of a slowdown in streaming music consumer behavior to accompany the revenue trend. Spotify and YouTube Music were the only leading DSPs to experience weekly active user (WAU) growth between Q2 2023 and Q2 2024. All other DSPs saw declines over the period. This is not a one-off event. Between Q2 2020 and Q3 2022, all DSPs experienced steady WAU growth. From then on, however, all experienced flattening or declining growth.

YouTube is worth taking note of as well. WAUs for watching music videos on YouTube have been in steady decline since Q3 2022, reflecting the growing competition from short form (both TikTok and YouTube’s own Shorts). YouTube Music app WAUs were up slightly.

The streaming slowdown is not restricted to DSP WAUs. The vast majority of monthly consumer streaming activities and wider monthly music behaviors, were also down.

[FEATURED REPORT: State of the music creator economy – The consumer era]

The pandemic triggered a surge in the music creator economy, which brought with it an influx of external interest and investment. 2022 saw growth moderate, but the long-term outlook is not only strong,…Find out more…

Secular trends are likely at play, namely cost of living pressures and growing competition for attention from other forms of entertainment. Interestingly though, the fact YouTube Music and Shorts, and TikTok related activities were the only ones to buck the trend is evidence of the bifurcation of music between DSPs and social, with the latter on the up.

But streaming value chain dynamics aside, Q2 24 was another quarter of solid growth across the wider music industry with leading labels, publishers, DSPs, and live music companies all registering growth once more. Total revenue across the fifteen leading music companies tracked by MIDiA were up 9.6% in Q2 2024, to reach $20.7 billion, with publishers and DSPs growing fastest.

Live continued its post-lockdown renaissance but the first signs of moderating growth are showing, with Live Nation’s and Eventim’s combined growth rate of 8.2% the first single digit growth rate since recovery started in Q2 21. There is no cause for alarm bells yet, but saturation of market demand for increasingly expensive live experiences will likely manifest in the coming years.

If you liked what you saw here, then check out the full report: Q2 2024 music metrics | Bifurcation is here

If you are not yet a MIDiA client, then drop us a line at businessdevelopment@midiaresearch.com

And as if you need any further persuasion, the data file with the report includes around a million consumer data points alongside quarterly company financials across labels, publishing, streaming and live, including separate sheets for major labels, publishers, and South Korea

Want the latest entertainment research and insights directly to your inbox? Our newsletter has you covered, click here to subscribe.