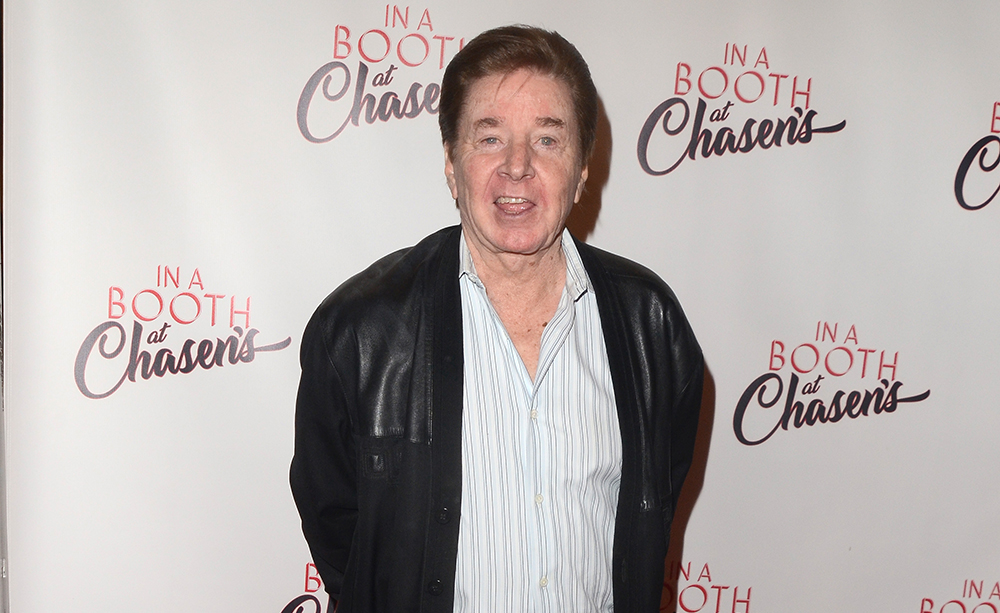

NEW YORK (VIP NEWS) — EDM promoter SFX Entertainment appears to be in need of cash. The company has agreed to sell some of its stock for $10 million in cash to Wolverine Flagship Fund Trading Limited and Virtual Point Holdings, LLC. In addition, an entity affiliated with Chairman and CEO Robert Sillerman (pictured) will purchase its own bulk of shares for $5 million in cash.

The buyers are getting a nice discount. Sillerman Investment Partners will pay $4.82 per share, or Wednesday`s closing price. Wolverine and Virtual Point will pay just $4.34 per share. Both prices are well below the $5.25 price Sillerman has offered to take the company private, an offer that the company accepted last month. Sillerman`s offer would take the company private, buying the 62.6 percent of SFX shares he doesn`t already own.

Investors took the stock sales as bad news. Shares of SFX fell as far as $4.27 and closed 8.1 percent lower at $4.43. About 4.9 million shares, over four times the daily average, swapped hands on Thursday. SFX isn`t exactly out of cash. It ended the first quarter with cash and cash equivalents of $45.8 million, down from $63.3 million a year earlier, and last year obtained a $30 million revolving credit facility. SFX had not yet responded to Billboard`s request for comment.

Sillerman`s acquisition offer of $5.25 per share could look considerably better after Thursday`s decline. The deal has yet to be approved by shareholders, some of whom were angered by Sillerman`s original proposal of $4.75 per share in February. Analysts believed a fair price was as high as $10 a share, although their estimates have since fallen. A perception that SFX is having liquidity problems could further change shareholders` opinions.

The investors won`t be investors for long. Sillerman has granted Wolverine and Virtual Point the right to sell the stock to him at $5.25 per share. Called a "put right," this allows the investors to unload some or all shares at a higher price (the same price Sillerman has offered other investors in order to take the company private).

The combination of low sale prices and put options suggests SFX may have urgent short-term cash needs. Wolverine and Virtual Point are making a short-term investment that allows them to sell their for a quick, assured profit. If shareholders approve Sillerman`s offer before June 17, or if Sillerman`s offer is beat by another buyer, Wolverine and Virtual Point can sell their shares for a profit. If the merger agreement isn`t completed by June 17, the companies can still sell those shares at a 17.3-percent gain.

Some observers believe SFX is in a difficult situation. "Clearly $SFXE needs liquidity," wrote New York-based hedge fund Maglan Capital on Twitter. "Can`t be a good situation."