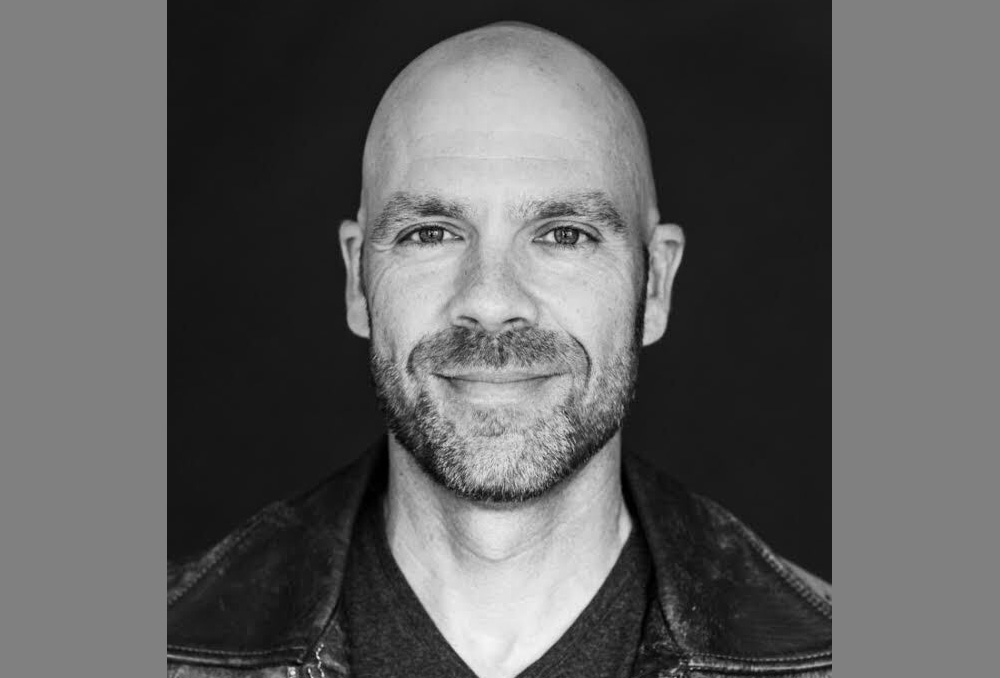

(Hypebot) — Music manager and ticket reform crusader Randy Nichols dives into how unchecked speculation and ticket “shorting” are turning concerts into commodities. Learn how fans, artists, and culture itself are paying a price for unregulated concert ticket resale.

Buy Low, Sell High: Perils of Unregulated Concert Ticket Resale

By Randy Nichols via LinkedIn

Why Event Tickets Should Not Be Treated as Unregulated Tradable Equities

In recent years, a dangerous shift in the perception and handling of event tickets has taken root—one that treats tickets not as access to a live experience but as speculative assets in a freewheeling marketplace. This framing, pushed aggressively by secondary ticketing platforms and the scalping industry, promotes the idea that tickets should be traded like stocks: bought low, sold high, and unshackled by any meaningful regulation. But tickets are not stocks. They are revocable licenses—granted by artists, teams, and promoters for fans to attend specific events under defined terms. Treating them as unregulated tradable equities undermines the cultural and economic fabric of live entertainment and exploits the very consumers it should serve.

A License, Not a Commodity

At their core, tickets are a license to attend an event under specific conditions. This means that the event organizer—whether it’s an independent artist or a major sports franchise—retains the right to control how tickets are sold, transferred, and used. Just like a private club can revoke access or set member terms, ticket issuers set pricing and policies to ensure fairness, accessibility, and fan safety.

By treating tickets as commodities, secondary platforms argue that once a ticket is sold, it should be freely resold at any price, with no regard for the intent of the original issuer. This interpretation strips artists and promoters of their rights, ignores consumer protection concerns, and invites unchecked market manipulation by profit-seeking speculators.

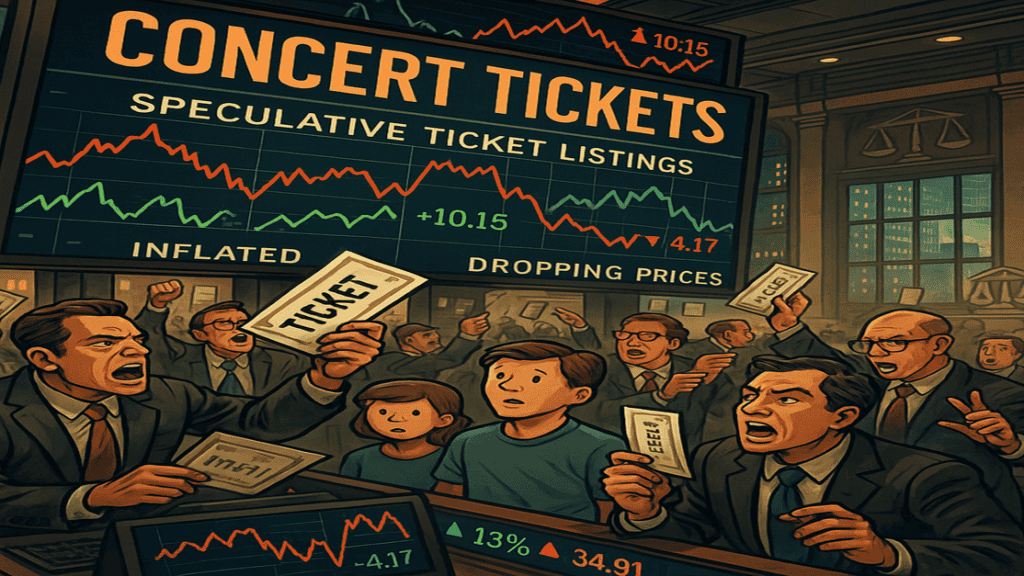

The Rise of Ticket Shorting

In financial markets, “shorting” refers to the practice of betting against an asset—selling something you don’t yet own in hopes of buying it back at a lower price to pocket the difference. This same practice has quietly become normalized in ticket reselling.

Scalpers frequently list tickets they don’t actually possess, a practice known as speculative ticketing. They “short” events—particularly those they believe will underperform—by listing seats on secondary sites at inflated prices ahead of the general public sale. If the event doesn’t sell well, they acquire tickets at cheaper prices later to fulfill the order. If the event does sell out, they often cancel the order entirely, leaving fans empty-handed or scrambling for alternatives at even higher prices.

This practice not only misleads consumers, it warps public perception of demand. Artificial scarcity inflates prices and creates a false sense of urgency that drives up costs for real fans. These scalpers are not entrepreneurs providing liquidity; they are unregulated speculators exploiting a vulnerable system.

Consumer Harm Is Real—and Measurable

Treating tickets like tradable stocks leads to tangible consumer harm:

- Exploitative pricing: Fans have seen $30 tickets balloon to over $100 after resale markups and fees. We’ve documented fees in New York as high as 127% of the original ticket price, and secondary marketplaces routinely tack on 40%+ service fees on top of already inflated scalped prices.

- Fake inventory and no guarantees: Because speculative sellers list tickets they don’t own, buyers are often misled into purchasing something that doesn’t exist, resulting in last-minute cancellations or worse—outright fraud.

- Market manipulation: By using bots, scalpers can buy up a large share of tickets before real fans have a chance, then turn around and resell those same tickets back to the fans they cut in front of.

These issues are not hypothetical—they are baked into the business models of the largest players in the secondary ticketing space.

This Is Not a Free Market—It’s an Unregulated Monopoly

Secondary ticketing is often portrayed as a bastion of free-market capitalism, where competition ensures fairness and consumer choice. In reality, it’s an opaque, manipulated ecosystem. A handful of platforms dominate the resale market, while bulk-buying software, bot networks, and affiliate marketplaces ensure that the average fan has almost no real opportunity to buy at face value.

Even worse, these platforms routinely fight attempts by artists, lawmakers, and regulators to enact basic consumer protections like face-value resale caps, bans on speculative listings, and fee transparency laws.

A Call for Real Regulation and Artist Control

The live event industry doesn’t need more financialization—it needs accountability. Artists and promoters should have the right to set the terms under which their work is experienced. Platforms and resellers should be held to standards of transparency, truth in advertising, and consumer fairness.

Some promising models exist. The Cure’s 2023 tour implemented a face-value exchange system that kept tickets affordable and scalpers at bay. But efforts like this are often blocked by outdated or loophole-ridden state laws—such as New York’s—which prevent enforcement of resale restrictions and price caps even when artists request them.

Conclusion

We don’t allow scalping of medicine, housing, or public utilities because those resources are too important to be hijacked for profit. Live events may not be essential in the same way, but they are culturally vital—and they should be protected from unregulated exploitation.

Tickets are not stocks. They are keys to human connection, art, and shared experience. Let’s stop treating them like poker chips and start respecting the people who make them possible—artists, fans, and independent promoters—by putting meaningful safeguards in place.