NEW YORK (CelebrityAccess) — Independent music company Concord announced it has raised $1.765 billion from investors as the company sets its sights on continued growth.

The funds were raised through the issuance of a series of new five-year, seven-year, and ten-year senior notes secured by a catalog of more than 1.3 million music copyrights, featuring The Beatles, Beyonce, Bruno Mars, Carrie Underwood, Creedence Clearwater Revival, Daddy Yankee, Ed Sheeran, Genesis, Imagine Dragons, John Fogerty, Kiss, Michael Jackson, Otis Redding, Phil Collins, Pink Floyd, R.E.M., Rihanna, Rodgers & Hammerstein, Taylor Swift, and The Rolling Stones.

The issuance is the forth such securitization for Concord and the ten-year tranche was billed as the longest duration ABS issuance at scale in the music sector.

Concord’s securitization catalog is valued at more than $5.1 billion and the notes were rated A+ by KBRA and A2 by Moody’s. The ABS transaction was structured by private equity giant Apollo through its Capital Solutions business and affiliates ATLAS SP Partners and Redding Ridge Asset Management and Apollo formed and led the investor syndicate of Apollo-managed funds and affiliates.

Proceeds from the fundraising round will be used to repay the company’s company’s $1.65 billion 2022-1 note series and refinance and extend its $100 million variable funding note.

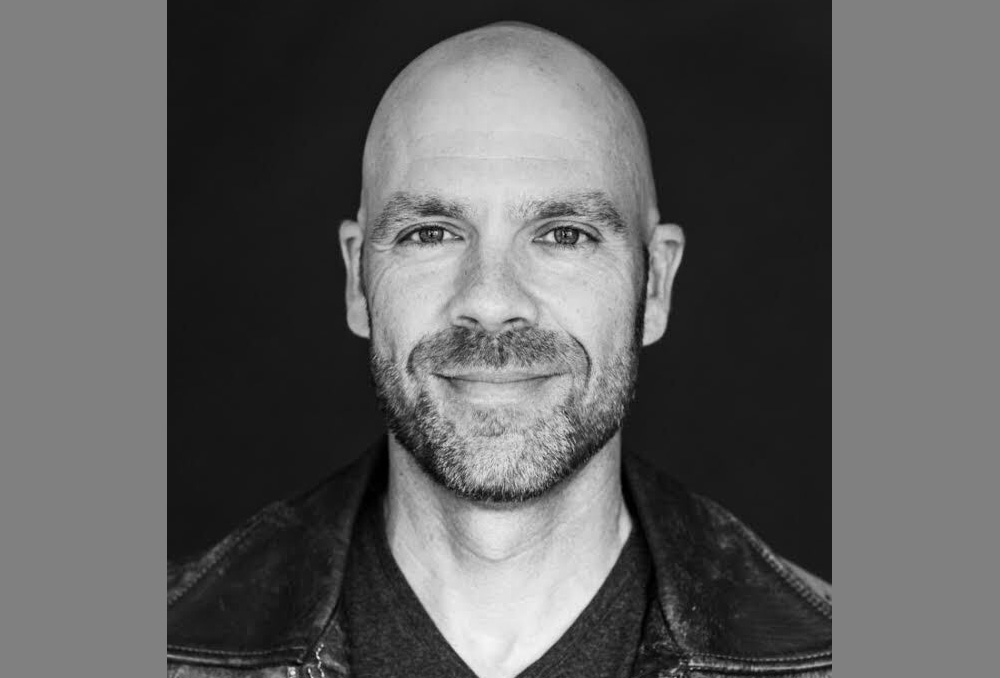

“As Concord continues to grow both our catalog and frontline roster, ensuring long-term access to institutional capital and continuing to build upon our strong financial foundation are crucial. ABS transactions like the one we just closed will remain a vital part of our growth strategy, allowing us to continue to lower our cost of capital while expanding our global capabilities in support of the artists and songwriters we serve,” said Bob Valentine, CEO of Concord. “I am incredibly grateful to the Apollo team, who continue to provide customized solutions so that Concord can live out its mission to elevate the voices of artists around the world.”

“We are pleased to structure and lead this landmark ABS transaction for Concord, which represents a continuation of our long-term financing partnership and demonstrates Concord’s innovative approach to music securitization through the issuance of the industry’s first 10-year tranche,” said Apollo Partner Michael Paniwozik. “We continue to be impressed by the quality and breadth of the actively managed catalog that Concord has built and look forward to supporting its journey for years to come.”