NEW YORK (CelebrityAccess) — Warner Music Group announced its financial results for the second fiscal quarter of 2025, reporting a modest dip in revenue alongside a sharp decline in net profit.

According to the company’s filing, revenue decreased by 0.7% in reported terms but rose 1.2% when adjusted for currency fluctuations. The decline was primarily driven by a slight drop in streaming revenue (−0.3% reported, +1.6% in constant currency), as well as lower income from Recorded Music artist services and expanded-rights. These were partially offset by growth in licensing, physical sales, and Music Publishing revenue—including gains across digital, performance, sync, and mechanical categories.

Recorded Music streaming revenue declined by 0.4% (or increased 1.6% in constant currency), while Music Publishing streaming revenue remained flat year-over-year (also up 1.6% in constant currency).

Operating income rose 41.2% to $168 million, driven in part by cost savings from a strategic restructuring and the absence of $82 million in charges incurred during the same quarter last year related to severance and divestitures.

However, net income fell sharply by 62.5% to $36 million, down from $96 million in Q2 2024. According to WMG, net income fell largely due to FX losses, hedging activity, and higher tax expense, despite operating income gains from restructuring.

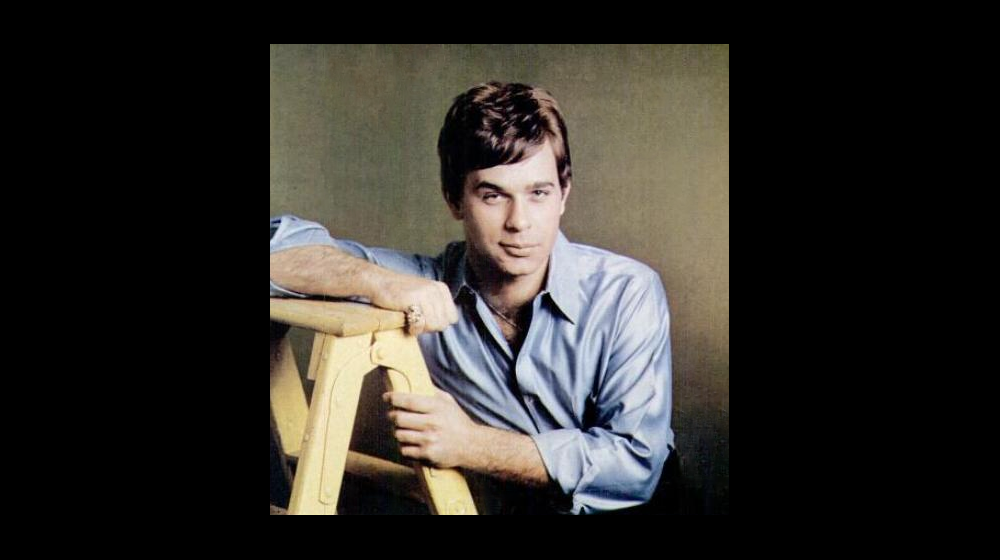

“Our strategy is starting to bear fruit, with our strongest chart presence in two years, translating to expanding new release market share in the U.S.,” said Robert Kyncl, CEO of Warner Music Group. “As we replicate our strategy across other labels and geographies, and drive a virtuous cycle of greater reinvestment, we expect to deliver lasting value for artists and songwriters, and sustained growth and profitability for shareholders.”