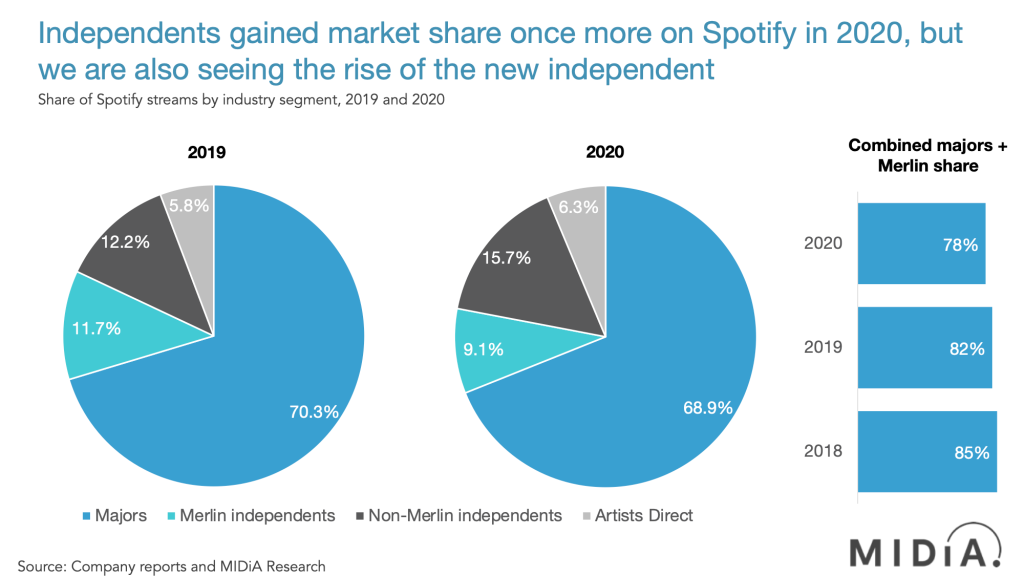

(Hypebot) — “The headline is that independents as a whole grew market share in 2020 from 29.7% to 31.1%,” writes MIDiA top analyst Mark Mulligan, and that trend is accelerating.

By Mark Mulligan of MIDiA and the Music Industry blog

Last year we identified a small but crucial metric from Spotify’s annual report: the share of all streams accounted for by majors and independent licensing body Merlin. It was crucial because it enabled us to segment the streaming market in detail when combined with market data from majors and independent artist platforms. The key takeaway was that independents grew fastest, but that not all independents grew at the same rate. Now the 2020 figure is out from Spotify and the trends have accelerated.

The share of Spotify streams accounted for by the majors and Merlin fell four percentage points in 2020 to 78%, down from a high of 85% in 2018. The recorded music market is one in which label market shares typically move at a near glacial pace. In comparison, this shift is nothing short of tectonic. What we are witnessing is not just the emergence of a new pattern of growth in the recorded music business but also the emergence of a new breed of record label.

Firstly, the methodological health warning: this percentage reported by Spotify refers to streams, not revenue, so will have some margin of error as there are certain types of labels that do better among ad supported users than paid, which means their contribution to revenue is less than to streams. Emerging markets such as India (which skew heavily to free users) will also over index. Also, non-Merlin independents will include by inference all record labels that are not majors and that are not Merlin licensed, so this will include big record labels in Korea, Japan, India etc. who in their own markets are the equivalents of majors.

All that said, the shares are still directionally invaluable and provide us with some great market insight. By applying the major labels’ market shares for revenue, coupled with artists direct (i.e. DIY) and independents overall, we can work out what the splits between Merlin, the majors and everyone else are.

The headline is that independents as a whole grew market share in 2020 from 29.7% to 31.1%. In 2018 the figure was 28.3%. That is nearly three whole points of market share gained. To drive such big shifts in market share in a fast growing market like streaming, big revenue growth is needed. The Spotify figures would suggest that majors grew by 14%, Merlin was down by 3%, artists direct were up by 28% and non-Merlin independents were up by 49%. As in 2019, artists direct and non-Merlin independents were the big winners. These two segments represent the new vanguard of streaming-era music strategy, entities that have learned how to use their smaller scale to be agile and play to the unique rhythms of streaming in a way that bigger, more established companies have not.

Merlin’s dip in streams may well not be reflected in revenues, as Merlin labels tend to over index for premium streams. Even if they were around flat or even slightly positive in revenue terms, the contrast with the newer breed of smaller independent labels is clear. Of course, not all Merlin labels are the same, but the category-level trend suggests that many Merlin labels might be stuck in the difficult middle ground between the agility of newer, smaller labels, and not having the scale of tech, data and catalogue to enjoy the same scale benefits that majors do.

Even with all the caveats considered, the direction of travel is clear: streaming is paving the way for a new breed of independent, one that is gaining share at the expense of both majors and traditional independents.

![Independent Artists And Smaller Labels Grew Fastest In 2020 [Mark Mulligan] Independent Artists And Smaller Labels Grew Fastest In 2020 [Mark Mulligan]](https://celebrityaccess.com/wp-content/uploads/2020/05/2481171803607718243.png)