SAN FRANCISCO, (AP/CelebrityAccess MediaWire) Macworld | iWorld kicks off this week at the Moscone Center West in San Francisco with more than 20,000 people Apple enthusiasts expected to descend, locust-like, on the event.

The expo will kick off with a launch celebration on Wednesday, January 25th at The Warfield in San Francisco, headlined by indie rock powerhouse Modest Mouse and produced in collaboration with Superfly Productions, the agency responsible for music festivals such as Bonnaroo, Outside Lands and Life is Good.

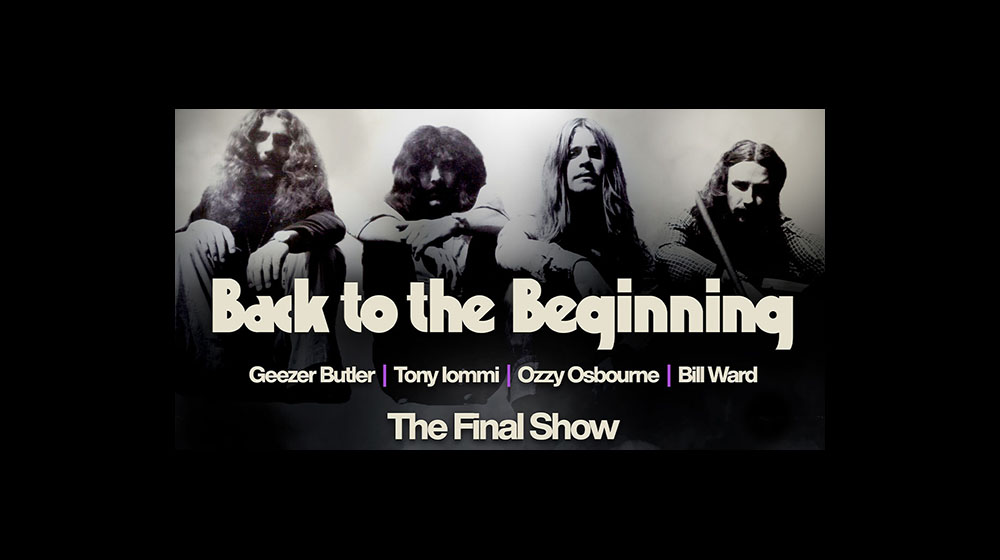

Debuting at this year's Macworld will be iWorld, the Music Experience will will focus on how Apple has shaped the music industry in the last decade. Apple is pushing the boundaries of innovation in music performance and production and feature special presentations and performances from some of today's most innovative and creative musical geniuses. Highlighted events and performances include: Hank Shocklee; moe.; the RISE Electronic Music DJ Battle & Bash, featuring BT and a competition between three of San Francisco's hottest up-and-coming DJs judged by DJ Solomon, DJ Dani Deahl, and DJ Ean Golden with event emcee "The Bastard Prince" of the Rondo Brothers and co-hosts The Cobra Snake and Jonny Makeup; a Silent 'Frisco dance party featuring Motion Potion, A.Skillz, and U9lift; Atomic Tom; Beats Antique; Eclectic Method; J Boogie's Dubtronic Science; David Mash; Sal Soghoian; the Macworld | iWorld Music Studio, presented in collaboration with Berklee College of Music; and a slew of Tech Talks led by topic experts on ways to leverage and maximize Apple and related tools for music creation, production and enjoyment.

In addition to music, the event will also feature a film festival showcasing both films created using Apple tech and the technology itself; Tech Talks with leading figures in entertainment and technology and a exhibitor hall chock full of the latest in Apple-related software and hardware.

Meanwhile, as the expo gears up, Apple posted their huge Q4 results.

NEW YORK (AP) — After uncharacteristically tepid sales in the July-to-September quarter, Apple came back with a vengeance in the last three months of 2011, vastly exceeding analyst estimates and setting new records.

Apple Inc. on Tuesday said it sold 37 million iPhones in the quarter, double the figure of the previous quarter and more than twice as many as it sold in the holiday quarter of 2010.

The result may make Apple the world's largest maker of smartphones. Samsung Electronics, which held that position last summer, has said it expects to report shipping about 35 million smartphones in the October to December quarter.

October saw the launch of the iPhone 4S, and the addition of Sprint Nextel Corp. as an iPhone carrier in the U.S.

Apple said net income in the fiscal first quarter was $13.06 billion, or $13.87 per share. That was up 118 percent from $6 billion, or $6.43 per share, a year ago.

Analysts polled by FactSet were expecting earnings of $10.04 per share for the latest quarter, Apple's fiscal first.

Revenue was $46.33 billion, up 73 percent from a year ago. Analysts were expecting $38.9 billion.

The Cupertino, Calif., company shipped 15.4 million iPads in the quarter, again more than doubling sales over the same quarter last year. The November launch of Amazon.com Inc.'s $199 Kindle Fire tablet didn't appear to put a dent in the iPad's sales, as some analysts predicted it would.

Apple shares rose $33.03, or 7.9 percent, to $453.53 in extended trading, after the release of the results.

Chief Financial Officer Peter Oppenheimer said the company expects earnings of $8.50 per share in the current quarter, and sales of $32.5 billion. Both figures are above the average estimate of analysts polled by FactSet, even though Apple usually low-balls its estimates.

Apple ended the quarter with a cash balance of a staggering $97.6 billion. That's more than enough to buy Citigroup Inc. outright, or issue a special dividend of $100 per Apple share.

For years, investors have been frustrated with Apple's unwillingness to put the cash to use, but complaints have been muted as Apple continues to generate record-breaking results and as the stock price keeps rising. Apple executives have said the cash hoard gives the company flexibility to make acquisitions and long-term supply deals.

If the stock rally in extended trading survives into regular trading Wednesday, Apple will retake the position of most valuable company in the world from Exxon Mobil Corp. Apple first unseated Exxon last summer, and the two have been trading places since then.

Apple's results lifted shares of smaller companies that supply chips for the iPhone, like TriQuint Semiconductor, up 7.7 percent, Cirrus Logic Inc., up 6.8 percent, Broadcom Corp., up 4.2 percent, and Skyworks Solutions Inc., up 3.7 percent.

Apple co-founder and longtime CEO Steve Jobs died Oct. 5, just as the record-breaking quarter started.